Listening to Sonos

Why they should go all-in on being a platform

If you’ve met me in person in 2025 and talked about investing, it’s very likely I’ve spoken to you about my interest in Sonos ($SONO, I’m long the stock). Sonos is sort-of a platform today, and I believe their long-term path to success is going all-in and building out a robust developer platform.

A brief history

If you’re not familiar, Sonos makes high-end speakers for your home that connect to each other over WiFi and are controlled by software to coordinate your listening experience. Sonos is the OG of wireless multi-room audio - they invented the category.

Here’s what the stock’s done in the last few years. To simplify: Sonos was once worth a lot more, briefly became a $1B market cap stock this year, and now it’s worth about $2B. In my opinion, at this valuation, they’ll either turn it around (I’ll describe how that could happen shortly) - or they get acquired.

What went wrong

The decline in the stock starting in 2024 is interesting, and is a rare public failure of release engineering.

In May 2024, to coincide with the launch of the Sonos Ace headphones, the company released a completely rebuilt mobile app that was supposed to improve the user experience but instead removed basic features and introduced widespread issues. Speakers would disappear mid-playback, volume controls failed, and music libraries would vanish from the app altogether. Features that customers relied on disappeared altogether.

Most people never hear about or experience botched software releases (at least ones unrelated to security flaws). You can see some of the technical details in this excellent post by a Microsoft engineer - but here’s a quick summary of what went wrong:

👨💻 Years of technical debt: They were dealing with an old codebase that was getting harder to maintain

⚠️ They ignored quality: The beta testing team raised multiple warnings, but the release went ahead anyway

🧪 Testing wasn’t good enough: Testing appears to have been done in ideal, staged environments than real-world scenarios in actual homes

😱 No phased rollout: They pushed the app update out to all users, instead of a phased rollout as is common practice today

🔃 No way or plan to rollback: The team couldn’t, or chose not to move back to the old version

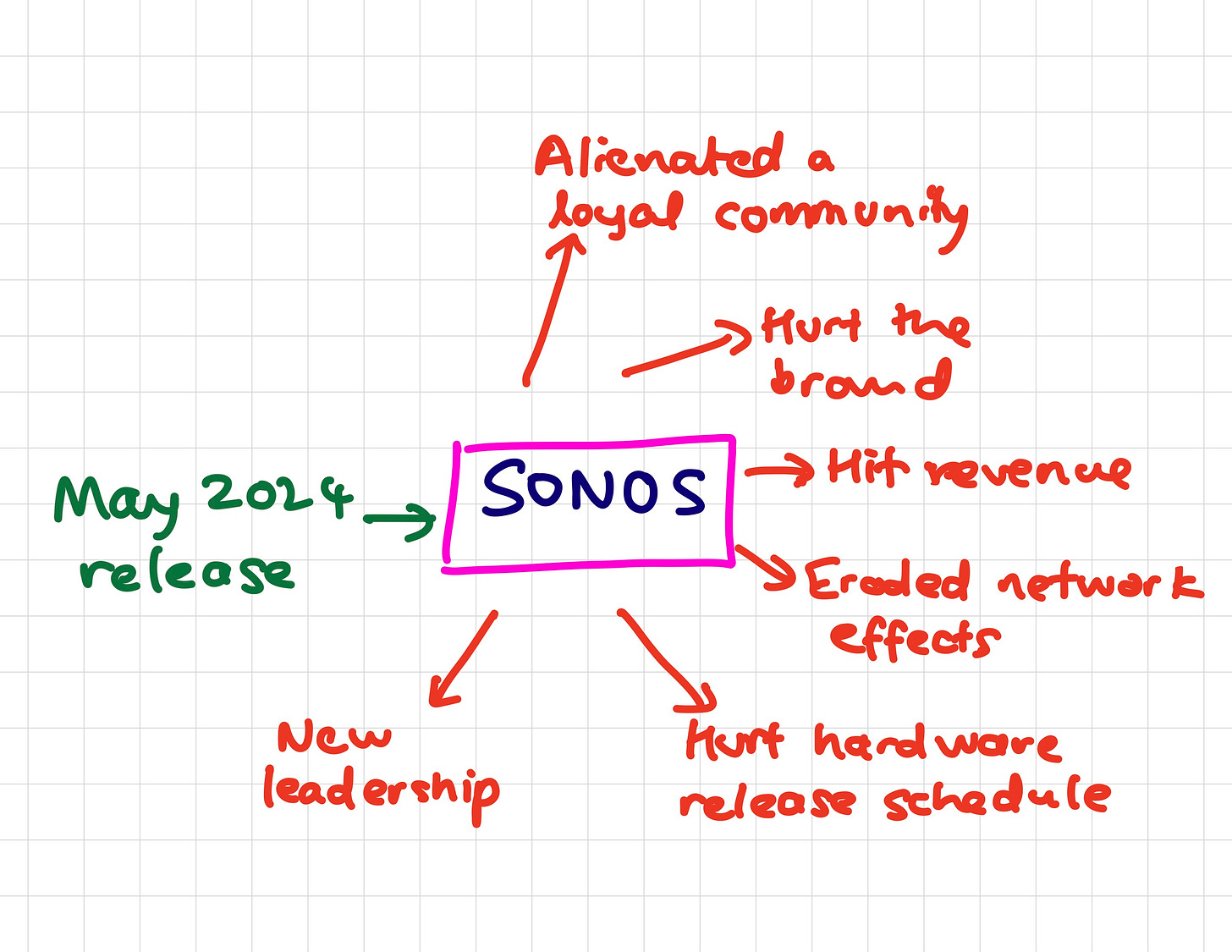

Needless to say this has had all sorts of effects on the company:

The bright side

It’s not all bad. Even with the missteps, they’re starting in a decent spot:

👍 Brand: Their first-mover advantage means that awareness and consideration are still good

📢 Hardware quality: The products are durable, look good in homes, and are generally perceived as premium

🌐 Distribution: While they haven’t leaned into their own retail presence as much as other hardware manufacturers, their reseller network is large

🏠 Footprint: They already have a presence in millions of homes. That’s pretty sticky - speakers are not generally items that people replace frequently

👨💻 Tech: Their tech is not easy to replicate. Sonos are the masters of synchronization, buffering, audio streaming - all tech that represents years of accumulated engineering props about edge cases in home networks

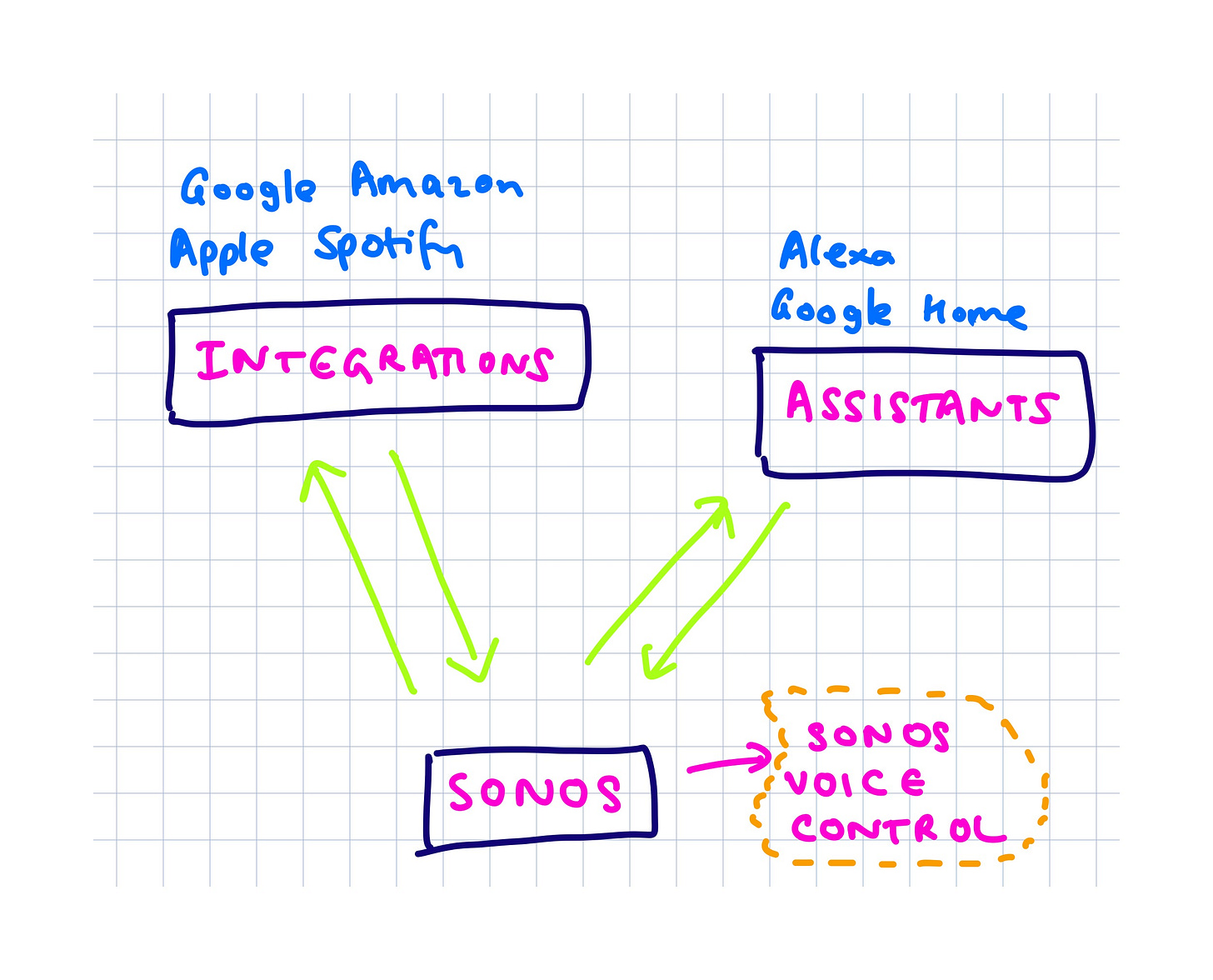

But Sonos doesn’t own any content. Their business has been built on integrations with third-party streaming services, OEM’s, and installers, so they’re stuck in the middle: dependent on Spotify and Apple Music for content, dependent on retailers for distribution, and now competing with partners who’ve built their own smart speakers. Here’s a simplified view:

This neutral positioning was once a strength, but now as AI assistants start getting better (see Alexa+), there’s a new wave of vertical integration happening: hardware, content and AI assistant all in one package. Sonos has their own assistant (Sonos Voice Control), but it underperforms away its first-party status on the hardware, and feels like it hasn’t been invested enough in.

Sonos only makes money on hardware, but competitors monetize the same customer repeatedly. Sonos has no recurring revenue stream, and no direct relationship with what people actually listen to on their excellent devices.

The path forward

Clearly they need to put their app troubles behind them, quickly. There are some early signs that this is happening.

On an ongoing basis, they also need to double down on their brand elevation, and maintain their premium positioning in the market. They’ve done some work in this area since last year (like this holiday campaign), but I think they need to go much deeper.

Lastly: Sonos and its family of products seem like a controlled ecosystem, but I think they’re a great platform in the making, with the potential to capture even better economics.

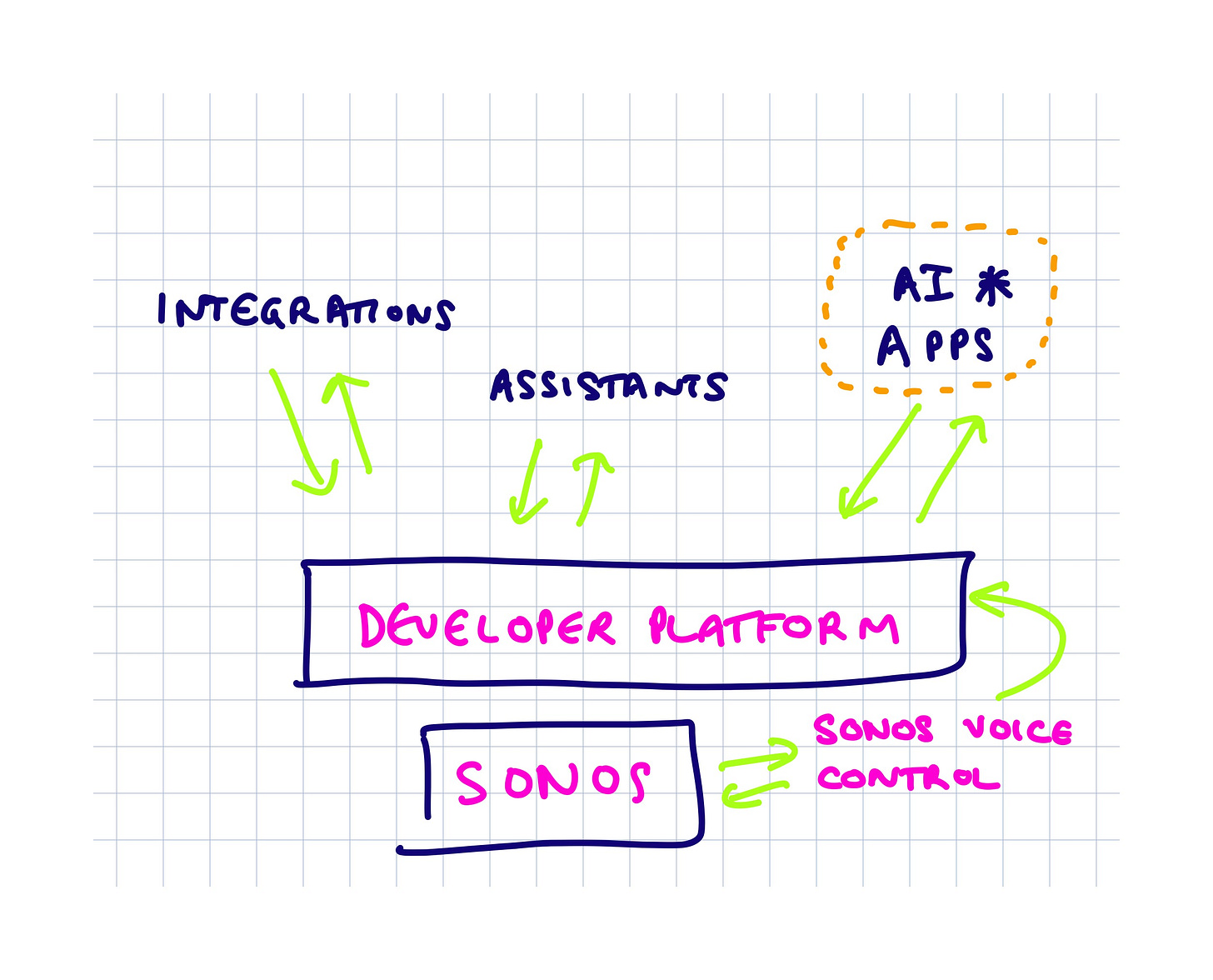

This is what it should look like, if they choose to get there:

Here are the steps they need to take, and why they’re consequential:

Rip out the existing “thin” API, and pivot into a full developer platform. All existing integrations and assistants, over time, become clients of that developer platform.

Invest in a proper developer portal, with Stripe-quality docs and developer relations. This is not in a great state right now.

Invest heavily into Sonos Voice Control, and roll that functionality into the developer platform. This instantly supercharges the ability of apps built on the platform.

Offer developers programmatic control over the home audio experience, including multi-room sync, context awareness and streaming (their particular area of expertise).

Enable new application categories, like AI agents that need audio output, productivity apps, fitness/wellness apps.

Perhaps most importantly: I believe there is a Cambrian explosion of AI-powered apps coming. They’ll be some version of personal, private assistants, utilities and experiences we’ve not seen before that bring AI into people’s homes.

If Sonos can position themselves as the default audio layer for those interactions, they could transform from a hardware company into a platform company with a recurring revenue engine.

I’ll grant that this is a stretch, but not an impossible one.